Insights

Article

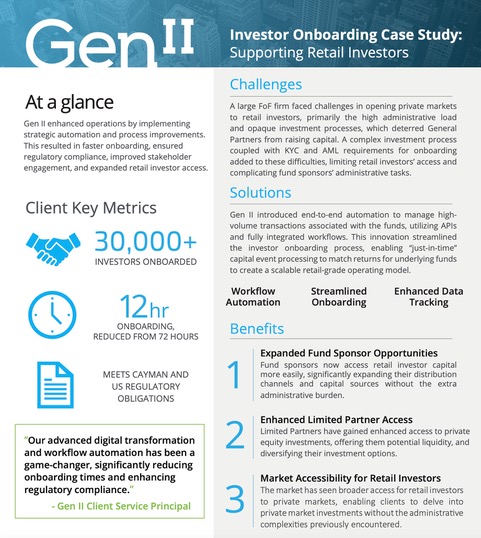

Case Study | Investor Onboarding: Supporting Retail Investors

Updated on: July 9, 2025

By implementing cutting-edge automation and process enhancements, Gen II has significantly accelerated the onboarding of investors, streamlined regulatory compliance, and expanded access for retail investors to private equity.

Overcoming Traditional Barriers

Historically, high administrative loads and opaque investment processes hindered retail investors' access to private markets. General Partners faced daunting challenges in raising capital due to complex investment processes and stringent KYC and AML requirements. Gen II identified these obstacles and crafted a solution that not only addressed these issues but also transformed the investment landscape.

A Revolution in Fund Management

Through the introduction of end-to-end automation and leveraging APIs, Gen II streamlined high-volume transactions associated with funds. This innovation has not only expedited the investor onboarding process but has also facilitated “just-in-time” capital event processing, creating a scalable, retail-grade operating model.

Transformative Benefits

The impact of Gen II's solutions included:

- Expanded Opportunities for Fund Sponsors: Easing the administrative burden and opening new distribution channels.

- Enhanced Access for Limited Partners: Offering liquidity and diversification in investment options.

- Market Accessibility for Retail Investors: Simplifying entry into private markets, previously marred by administrative complexities.

A Step Towards Inclusive Investing

Gen II's approach significantly reduced onboarding times, from 72 hours to 12 hours, while ensuring compliance with regulatory standards. This highlights Gen II's commitment to innovation and marks a significant step towards inclusive investing, providing retail investors with opportunities that were once out of reach.

Gen II's digital transformation exemplifies how strategic automation and process improvements can dismantle traditional barriers, and increase access to private market investments. As the financial landscape continues to evolve, such innovations will play a pivotal role in shaping the future of investing, making it more accessible and efficient for all.

Published on: February 23, 2024

Explore Insights

Gen II Fund Services, LLC

1675 Broadway, 4th Floor

New York, NY 10019

212-408-0550

info@gen2fund.com

General Inquiries:

888-GEN2-001

Press Inquiries:

North America: tfaust@stantonprm.com

Europe: dan.jason@wearematerialimpact.com

Report Personal Data Breach >