Insights

Article

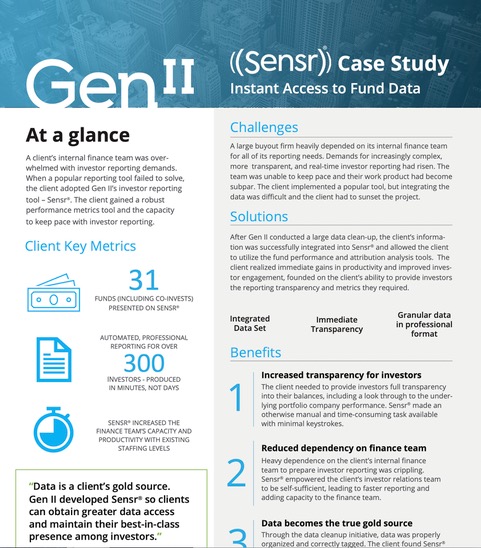

Case Study | Gen II’s Sensr®: Instant Access to Fund Data

Authored by: Peter Rosenstein, Chief Product Officer, Digital Solutions

Published on: November 9, 2022

Elevating investor engagement with transparent, accessible performance reporting

In the early days of an emerging buyout firm, its internal finance team could easily fulfill the requests for investor reports.

When success placed the firm among the world’s leading private equity houses, the scale of the operation began to slip; manual, in-house reporting became a liability instead of the hallmark for personalized, bespoke service.

Scale was just one issue. Overwhelming requests for benchmark and performance reporting – at the fund and the investor level, aggregated and disaggregated, with look throughs to portfolios – became challenging given the firm’s dependence on spreadsheets. Therefore, a constant influx of “re dos” and investor complaints became routine as the finance team did not have the resources to effectively develop transparent reporting. Unfortunately, the onboarding and integration of a popular reporting tool soon proved difficult and only exacerbated the issue.

When the finance team meet with Gen II, three missteps were quickly realized:

- Selecting a technology that was difficult to integrate and not intuitive to use

- Adopting a reporting tool without conducting a throughout data inventory

- Failing to identify how data would be consumed by fund sponsors

Structuring data to be accessible, transparent, and consistent – so as to be dependable and reportable – was required for minimizing backlogs and utilizing transparent, standardized formats.

Another change was also needed. Due to the complexity of their manual process, only the finance team could fulfill investor report requests. To address these issues, Gen II suggested conducting a large-scale data cleanup and implementing Gen II’s Sensr®, a fully integrated performance reporting tool.

Working closely with the firm, Gen II helped to evaluate their data and lead the data cleanup then identify their investor needs and develop custom report dashboards within Sensr®; this enabled other teams to generate reports as well, increasing the finance team’s capacity. Now equipped with a structured data set and an intuitive performance reporting tool, the firm can confidently provide investors performance reports quickly and accurately.

Explore Insights

Gen II Fund Services, LLC

1675 Broadway, 4th Floor

New York, NY 10019

212-408-0550

info@gen2fund.com

General Inquiries:

888-GEN2-001

Press Inquiries:

North America: tfaust@stantonprm.com

Europe: dan.jason@wearematerialimpact.com

Report Personal Data Breach >